Some Known Questions About Insurance Brokerage.

Table of ContentsThings about Insurance BrokerageWhat Does Insurance Brokerage Do?What Does Insurance Brokerage Do?A Biased View of Insurance BrokerageWhat Does Insurance Brokerage Do?A Biased View of Insurance Brokerage5 Easy Facts About Insurance Brokerage Described

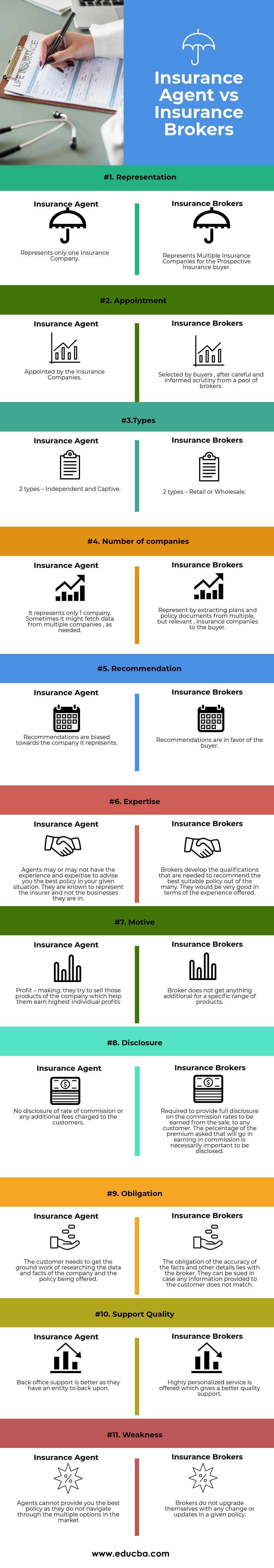

Insurance brokers represent consumers, not insurance policy firms; for that reason, they can not bind coverage on behalf of the insurance provider. That's the duty of insurance policy agents, who represent insurance business and can finish insurance sales - Insurance Brokerage., depending on state policies. When you work with an insurance policy broker, they function straight for you. An insurance representative, on the other hand, usually functions on behalf of an insurance policy business.

Not known Facts About Insurance Brokerage

An insurance policy broker can not shut a deal on a policy, just a representative or an insurance policy firm can. Insurance coverage brokers require a state certificate to practice.

Selecting the appropriate insurance strategy can be complicated, and also research studies reveal that lots of individuals pick a less-than-optimal plan when they depend entirely on their own judgment. Being skilled on offerings from all insurance policy business, brokers ought to not prefer any type of certain firm.

Not known Factual Statements About Insurance Brokerage

— Cloud Links (@ldcloudlinks) December 20, 2022

Along with attaching clients to the ideal plan, the broker remains to have responsibilities to his customers. A broker offers consultative services to aid clients send claims and get advantages, in enhancement to figuring out whether plans should be altered. To stay up to date with altering laws and guarantee they are proceeding to satisfy their tasks, brokers are accredited by state insurance policy regulative companies.

Insurance policy brokers can handle as lots of types of insurance coverage as they are comfortable selling, becoming a professional in one might be advantageous. Brokers have to be accredited in the state where they exercise and also pass Collection 6 and 7 FINRA-administered examinations. Maintaining to day on changes in insurance regulations is an excellent way to maintain clients positive as well.

The Greatest Guide To Insurance Brokerage

They function as a liaison in between their customers and also insurance policy companies. Insurance Brokerage. There are many types of insurance and insurance policy companies that it can be difficult to do enough research in order to make a wise choice for your demands as well as budget plan. An insurance coverage broker takes duty for the research study and also aids assist their clients to make the appropriate option, making a compensation in the process.

(ANZIIF) Certified Insurance Coverage Expert (CIP) as well as National Insurance Coverage Brokers Organization (NIBA) Certified Practicing Insurance Broker (QPIB) certifications.

The 15-Second Trick For Insurance Brokerage

Insurance coverage brokers as well as insurance representatives are licensed and managed by the same entity in the majority of copyright; either an arms-length company, such as the General Insurance Policy Council of Saskatchewan, or directly by a federal government body. In some districts, such as Ontario, insurance coverage brokers have self-governing bodies responsible for licensing and also law.

In order to obtain a broker's license, an individual commonly must take pre-licensing courses and pass an evaluation. An insurance broker also have to send an application (with an application pop over to these guys fee) to the state insurance policy regulatory authority in the state in which the candidate wishes to do service, that will certainly identify whether the insurance broker has actually satisfied all the state requirements and also will normally do a background check to figure out whether the candidate is thought about reliable and qualified.

The Basic Principles Of Insurance Brokerage

Some states additionally need applicants to submit finger prints. When accredited, an insurance policy broker normally need to take continuing education and learning courses when their pop over to this site licenses get to a revival day - Insurance Brokerage. For instance, the state of The golden state calls for certificate revivals every 2 years, which is completed by finishing proceeding education programs. Many states have reciprocity arrangements where brokers from one state can come to be easily licensed in another state.

Some Known Details About Insurance Brokerage

Oversight on the part of insurance coverage brokers can have serious impacts upon clients when they discover their insurance coverage is worthless. In one situation, Near North Home entertainment Insurance Providers provided different rock band Pineal eye Blind with a business general obligation (CGL) insurance coverage that left out insurance coverage for the "enjoyment business".